Car Insurance Discounts on Multi-policy Insurance in San Mateo, CA - Gavop

Car Insurance Discounts on Multi-policy Insurance in San Mateo, CA - Gavop |

- Car Insurance Discounts on Multi-policy Insurance in San Mateo, CA - Gavop

- Getting Cheap Car Insurance for New Drivers - NerdWallet

- How to Find the Cheapest Car Insurance for Your Teen - MoneyWise.com

- Vapers, like smokers, may pay more for life insurance: Prudential to treat users of e-cigarettes like smokers - CBS News

| Car Insurance Discounts on Multi-policy Insurance in San Mateo, CA - Gavop Posted: 29 Oct 2019 12:00 AM PDT By: Gokul Menon October, 29, 2019 San Mateo, located near San Francisco, has a population of 769,000. The average rate of car insurance in the county is $1,296. However, car owners can save up to $520 by comparing quotes and reviews on Gavop.

BUNDLING: Multi-policy insurance is the best way of increasing savings. For instance, State Farm offers savings of up to $854 on bundling home, condo, or car insurance. Moreover, Progressive offers savings of up to $1029 on bundling auto with home, or renters insurance. Allstate, on the other hand, offers a 10% discount on auto and 25% on home insurance if bundled together. It also offers discounts to drivers that bundle auto and life insurance together. USAA helps in saving up to 10% on property and auto insurance bundled together. DRIVING RECORD: Most car insurance companies offer substantial discounts to drivers who have a clean driving record. For example, GEICO offers a 26% discount to drivers with a spotless driving record for five years. On the other hand, State Farm offers discounts when a driver goes three or more years with an accident-free record. With the advent of modern technology in the car insurance industry, Usage-Based Insurance (UBI) is increasingly being used to personalize car insurance. UBI works through both plugin devices and mobile apps. It keeps track of various factors in one's car, making insurance rates more personal. Progressive's SNAPSHOT program offers a significant discount for good drivers. It places its average rate of discount at $145. The DriveSense discount program by Esurance is another option for car owners looking for discounts. HYBRIDS AND ELECTRIC VEHICLES: Gavop found that Farmers and Travelers are among the few companies that offer discounts on alternative-fuel vehicles. Hybrids and Electric Vehicles are more environmentally friendly thanks to lower emission rates. Farmers offers these car owners discounts of up to 5% in some states. STUDENT DISCOUNTS: Teenagers in San Mateo pay $2,825 a year in car insurance. Though they bear the brunt of being inexperienced drivers, insurance companies offer discounts to teenage students that have good grades in school. Allstate, for instance, offers stellar discounts to smart students based on their grades and proximity to the school (100 miles). Alongside these requirements, the teen user must be under the age of 25, and must also complete Allstate's "teenSMART Driver Education Program." State Farm's "Good Student" program offers discounts of up to 25% to teenage students who have good grades. Farmers offers similar discounts to students (with good grades) under the age of 25 as well. ABOUT THE AUTHOR Gokul MenonGokul works as a writer at Gavop. He holds an M.A. in Comparative Literature from the University of Hyderabad and a Bachelor's in English from Madras Christian College. He has been a part of a couple of theatre groups, like Masquerade Youth Theatre and Theatre No. 59 and enjoyed being a part of Literary and Debating circles in Chennai. Gokul is an avid reader and has presented a few academic papers. He spends more time on Goodreads, than on any other social media platform.  |

| Getting Cheap Car Insurance for New Drivers - NerdWallet Posted: 11 Jul 2019 12:00 AM PDT  At NerdWallet, we strive to help you make financial decisions with confidence. To do this, many or all of the products featured here are from our partners. However, this doesn't influence our evaluations. Our opinions are our own. Most new drivers are young people getting behind the wheel for the first time, but to car insurance companies, anyone without a recent driving record represents the same risk. So older drivers who are immigrants, foreign nationals and U.S. residents who haven't driven — or had an auto insurance policy — for a period of time may all be considered new drivers and face similar issues getting insured. It may take diligence to get a good rate, so be sure to compare quotes online from as many companies as you can. Car insurance for new drivers under 25

Auto insurance companies can justify higher charges for teenagers and people in their early twenties because they're more likely than any other age group to cause accidents. If you're a new driver in your teens or early twenties, the best way to get cheap insurance is to stay on your parents' policy for as long as you have the same permanent address. » MORE: Finding the Cheapest Car Insurance for Teens Beware that "cheap" is relative here — adding a teen to a married couple's policy is likely to (at least) double their rate, according to NerdWallet's analysis. However, going it alone is likely to be more expensive — always compare multiple insurance quotes online to be sure. Some good news: Insurance companies offer plenty of discounts for students and young drivers, and your rates will get better over time as you drive safely. When you're ready to get your own insurance policy, you can ask your parents' carrier for a quote, but also get a couple of others to be sure it's a good price. » MORE: Compare car insurance Car insurance for immigrants and foreign nationals

Even if you have a long history of safe driving in another country, insurance companies consider you a new driver when pricing a policy in the U.S. for the first time. Since they access only domestic driving records when setting rates, only your driving history in the U.S. counts. This also goes for your credit history, which is also used to help calculate auto insurance rates in all but three states — California, Hawaii and Massachusetts. » MORE: Financial Guide for Immigrants in the U.S. Without a valid U.S. driver's license, you'll have a hard time getting an insurance policy from any company, even if you have an international driver's permit. In that case, if you're renting a car, the easiest option may be to use the rental car company's coverage. If you plan on staying and driving in the U.S., it's best to take steps to get a driver's license in the state you're residing in. Some, such as California, will issue a driver's license to an undocumented immigrant. Once you have your license, get at least three auto insurance quotes so you can choose the best rate and coverage. Car insurance after a driving or coverage gap

Maybe you spent some time abroad or your license expired because your lifestyle just doesn't require any driving. Without a driving history to check, insurers can still consider you a new driver. And without continuous auto coverage, they can consider you a high-risk driver, which has similar effects on car insurance rates. Even if you have some driving history to reference, it's important to shop around for your next policy since you'll likely pay more just for having a gap in coverage. There's an exception for military deployment from many companies, so be sure and ask if that applies to you. Since continuous coverage is one of the most important factors insurers consider, some may not accept your application if you've had gaps between policies. If that's the case, you can look for nonstandard insurance companies that specialize in coverage for people having a hard time getting insured. |

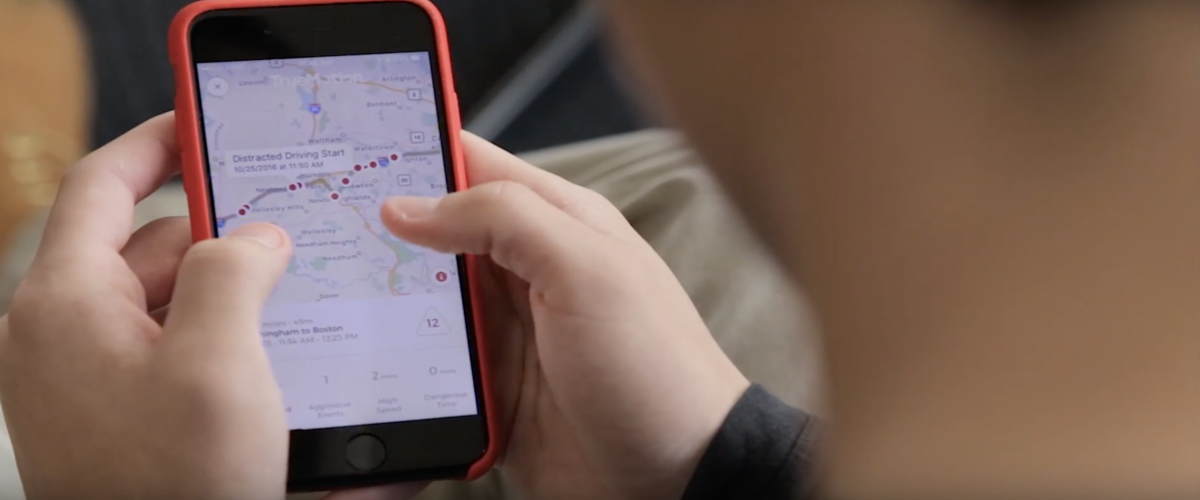

| How to Find the Cheapest Car Insurance for Your Teen - MoneyWise.com Posted: 19 Mar 2019 12:00 AM PDT Even responsible kids lack the skill and experience to avoid accidents. The Insurance Institute for Highway Safety, or IIHS, reports that teen crash rates per miles driven are three times those of 20-year-olds. If you live in Rhode Island, which sees the highest car insurance spikes for teens, according to insuranceQuotes, you could always relocate to Hawaii, which has the lowest. However, there are more practical ways to minimize the pain. 1. Add the teen driver to an existing policy Teenager getting driving lessons from her dad. In general, it's cheaper to add a teenager to an existing policy than to buy a separate plan. Insurance companies offer the deepest discounts to customers who buy coverage for several cars, especially if those clients purchase other products like life insurance. There is one exception. Many insurers rate teens on all the vehicles listed on the policy. If the policy covers several pricey cars, the premium will skyrocket even if the teenager never drives those cars. Insuring a cheaper car for the teenager on a separate policy would make sense in that scenario. 2. Choose the right vehicle The IIHS recommends midsize or larger cars and crossover vehicles for teens, like the Honda CRV. Insurance companies reward families who choose safe, sensible cars. The IIHS publishes an annual list of the best used cars for teens. The National Highway Traffic Safety Administration (NHTSA) is a great resource for safety ratings. Size and weight matter. Tiny cars just don't fare well in crashes, and their passengers usually don't either. The IIHS recommends midsize or larger cars and crossover vehicles. Steer clear of sports cars and vehicles with high horsepower. They are not only costly to insure, but they encourage speeding and other risky behaviors. 3. Stock up on safety features According to an NHTSA study, even air bags are less effective than seat belts in saving lives. Cars with certain safety features are cheaper to insure. Electronic stability control (ESC), for example, makes driving safer on curves and slick surfaces. ESC was mandated as a standard feature starting with 2012 models, and is on many slightly older cars. Anti-lock brakes, anti-theft devices and lane departure warning systems also impress providers. It's worth mentioning that seat belts might still be the most important safety feature. According to a NHTSA study, even air bags are less effective than seat belts in saving lives. Buckle up, and insist that your passengers do the same. 4. Shop around An internet search will bring up rate comparisons on car insurance for young drivers. It never hurts to do a little research and shop around, as some companies are more teen-friendly than others and may be willing to provide a special car insurance discount. Erie Insurance, for example, offers a discount of up to 20% for drivers who are under the age of 21, unmarried, and live with their parents. The best time to start browsing is before the learner's permit is issued. An internet search will bring up rate comparisons on auto insurance for young drivers. Local independent agents who work with several companies can also point shoppers in the right direction. On the flip side, it's sometimes better for parents to stick with their current insurer. Providers are often willing to forgive minor accidents if they have a longtime relationship with the policyholder. A multivehicle discount can save more money than a cheaper rate. 5. Get a firm quote If you've had an accident or been issued a ticket in the last five years, be honest about it up front. When asking about rates for your teen, be as specific as possible about the vehicle you want to insure. Agents can toss out a ballpark figure based on the make, model and year, but the vehicle identification number, or VIN, locks in the rate. The quoted rate will be inaccurate if dings on a kid's driving record are discovered. If there have been any accidents or tickets, be honest about it upfront. Get a definite answer before you cancel an existing policy or pay the first month's premium. 6. Ask about special discounts Most insurers offer discounted car insurance rates for teenagers with good grades. Insurers love teenage drivers who make good grades. Allstate's Smart Student program, offering discounts of up to 35%, is a good example. In the eyes of the insurer, responsibility and initiative with school translate to a safe and responsible teen driver. Check with your insurer to see their minimum grade requirements, and keep that glowing report card handy. Families that don't qualify at first can ask for the discount when grades improve. Some providers offer additional discounts for completing approved drivers' education programs or defensive driving classes. Teens who attend college at least 100 miles away and leave their cars at home are eligible for student-away discounted rates. 7. Modify the existing policy Sometimes it's not worth having collision and comprehensive coverage for older cars. If your teen drives an older vehicle that isn't worth much, consider dropping the collision and comprehensive coverage to reduce premiums. You may be paying more in premiums than you would recoup from the insurance company if the car were totaled or stolen. Consult Kelley Blue Book online to find out what your cars are worth. Conversely, raising comprehensive and collision deductibles to at least $1,000 accomplishes two things: It lowers premiums and removes the temptation to file small claims that might lead your insurer to raise your rate. 8. Consider a graduated driver's license program Graduated license programs slow things down with a written test and two practical driving tests, spread across a few years minimum. All 50 states and the District of Columbia offer graduated driver's license (GDL) programs for fledgling drivers, which proceed at a slower pace and gradually add privileges. Programs vary by state, but most have an intermediate licensing requirement between the learner's permit and a full license. In the intermediate period, new drivers have a chance to gain some experience and earn their parents' trust. They have to follow certain rules such as not driving unsupervised at night or carrying more than one passenger. GDLs have been shown to reduce accidents, and that lowers everybody's insurance rates. 9. Suggest that your teen delay getting a license A surprising number of teenagers revealed they prefer walking, biking, or taking public transportation. Persuading kids to delay driving is tough, but auto insurance for young drivers gets cheaper each year through age 19. More and more teens appear to be holding off. In 1983, 46% of 16-year-olds were licensed; after 31 years, the number had decreased to 24%, a study from the University of Michigan Transportation Research Institute reveals. Some kids said they were too busy to learn to drive while others cited the expense and hassle. A surprising number said they just preferred walking, biking, or taking public transportation. Pitch this as an opportunity to become part of an exciting national trend. It never hurts to ask. 10. Kids, drive safely One in three teenagers admit to texting while driving. Accidents and tickets have a huge impact on auto insurance rates, but there are far better reasons to slow down and pay attention. Speed is a factor in 31% of fatal accidents involving teens, according to NHTSA. The agency reports that among teenagers who text, 1 in 3 admits to texting while driving. Texting increases the risk of crashing by a factor of 23. Distracted driving, such as eating, gabbing with passengers, applying makeup or messing with the radio, is a factor in 15% of accidents with injuries. In short, one of the best ways to save money — and lives — is to drive safely. 11. Parents, monitor young drivers American Family's Teen Safe Driver program is powered by TrueMotion, an app that helps you monitor your teenager's driving habits. In 2008, an Iowa woman snooped around and found a bottle of vodka under the seat of her teenage son's car. She promptly sold the car. "Call meanest mom on the planet," her ad read. Even the brightest teens sometimes make boneheaded decisions. The potential consequences, like DWI, are outrageously expensive at best and tragic at worst. Many providers offer teen-driver programs with monitoring devices. American Family's Teen Safe Driver program, for example, uses an app to score teens on their driving safety in real time. Enrollment in the program offers parents a 10% discount on insurance after one year and a better sleep at night. Even snooping is better than nothing. Don't hesitate to be the meanest mom or dad on the planet. |

| Posted: 20 Nov 2019 07:38 AM PST

E-cigarette users may no longer be able to purchase life insurance at cheaper rates than those who smoke regular tobacco products. As more illnesses and, in some instances, deaths are reported from vaping, insurers now appear to be charging the same high premiums for both categories. The nation's fourth-largest life insurer, Prudential, says vapers who inhale from a hand-held electronic vaporizer rather than a traditional cigarette will now be classified as regular smokers and pay more when applying for individual life coverage, according to a company statement on Wednesday. "Prudential will reclassify users of e-cigarettes to treat them as smokers and in line with our cigarette smoking guidelines," a company spokesman said. "Smokers typically will have higher-priced policies." Smokers pay about 50% a year more than vapers, according to the website Dipsurance, which provides insurance quotes. Those savings for a term life policy could amount to $350 to $800 a year, depending on the health of the applicant. Prudential's announcement is the latest blow to the e-cigarette industry, which is already reeling from negative publicity, chain stores refusing to sell its products, as well as state regulators taking action against the once-burgeoning business. Earlier this month, the Centers for Disease Control and Prevention (CDC) warned against its use, citing more than 1,000 illnesses related to vaping and 18 deaths. The tide of bad headlines is unfair to the e-cigarette industry, said American Vaping Association President Gregory Conley: "They are the result of so many governmental officials spreading misinformation and doubt about nicotine vaping products. Those illnesses and deaths are almost exclusively caused by the use of illicit and contaminated THC (marijuana) cartridges." But that may not be enough to satisfy the conservative life insurance industry, which relies on extensive multi-year data to reach its decisions. "There hasn't been enough statistical data to say whether or not they're as bad as traditional cigarettes. Let's not forget that it took 20 or 30 years before that connection was made," said Vice President Loretta Worters of the Insurance Information Institute. "Before you pick up that e-cigarette, people should ask themselves, 'Is it worth the risk?' "she added. According to insurance quote sites, other companies providing a discount to vapers include Global Atlantic Life, MassMutual and United of Omaha. A MassMutual spokesperson said the insurance company's underwriting guidelines classify vapers as tobacco users, the same as smokers, and offers no discount. The other insurers didn't return calls or email requests seeking comment. The American Council of Life Insurers said it doesn't request this information from its members since insurers usually don't discuss premiums or policy guidelines. E-cigarettes have grown in popularity because they're considered a way to wean traditional smokers off tobacco and don't have the harmful side effects of the contaminants in cigarettes, such as tar. Conley said studies have shown that nicotine vaping products pose at least a 95% less risk to the public than cigarettes. Evidence of smoking either e-cigarettes or tobacco shows up in the blood test that is usually given to those applying for a life insurance policy. Term life policies, which generally expire after 10 to 20 years, offer no death benefit or payout at the end, as opposed to whole life policies, which do. |

| You are subscribed to email updates from "Teenage Life Quotes,life insurance quotes" - Google News. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

Comments

Post a Comment